Join us for three days of connecting, discovery, updates from the Council, regional community speakers, merchants, industry experts, and more.

Agenda subject to change – Continue to check back

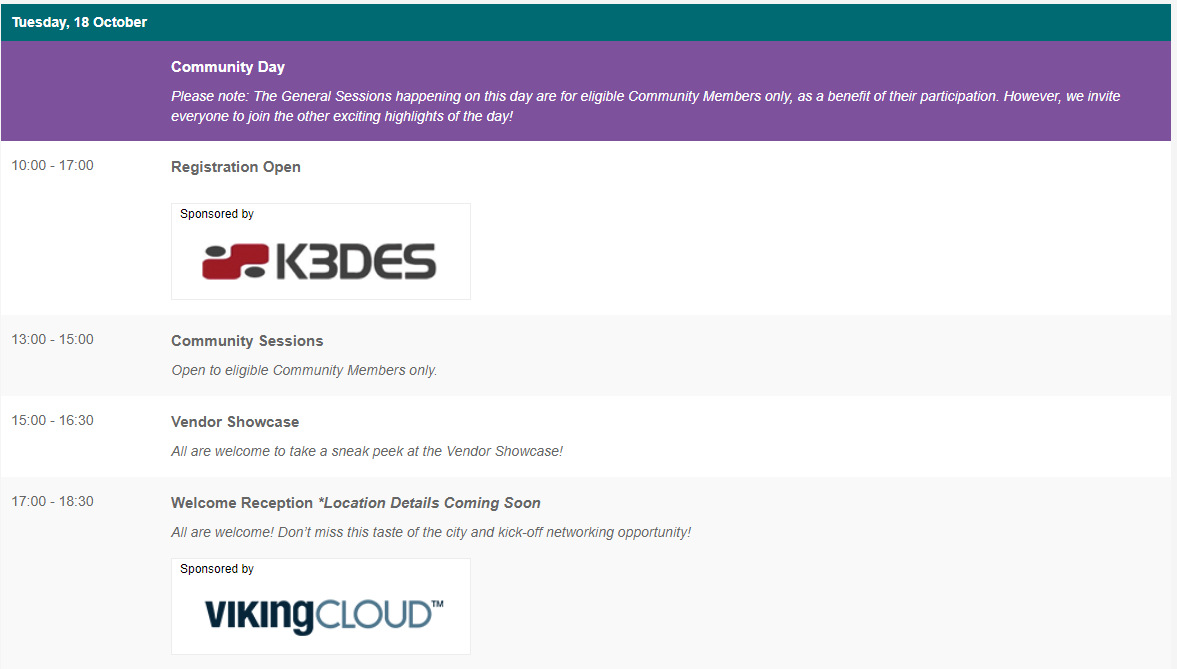

- Tuesday, 18 October

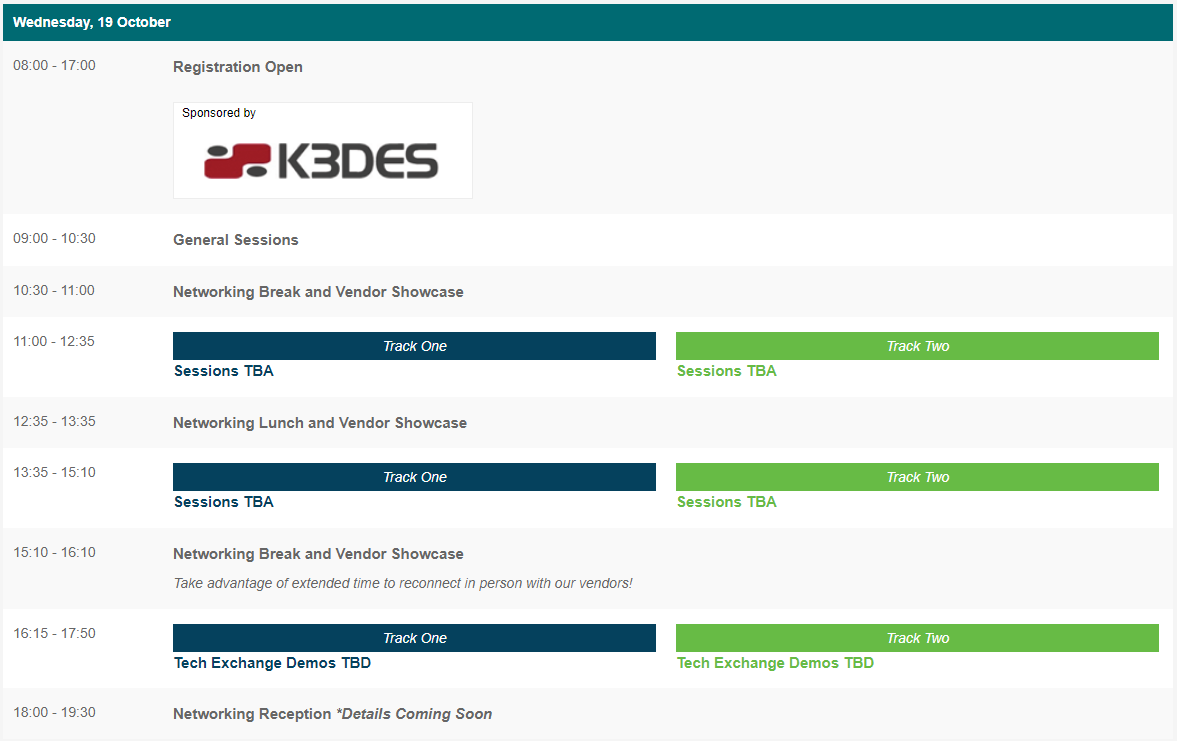

- Wednesday, 19 October

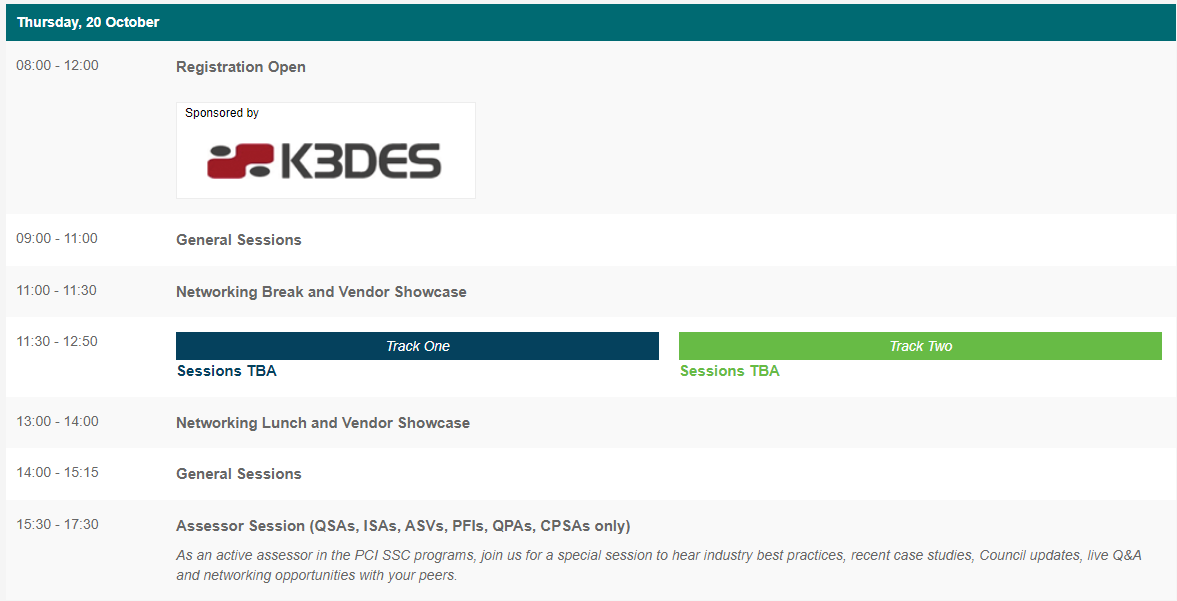

- Thursday, 20 October

Tuesday, 18 October

Community Day

Please note: The General Sessions happening on this day are for Participating Organizations only, as a benefit of their participation. However, we invite everyone to join the other exciting highlights of the day!Welcome Remarks

Emceed by: Sherron Burgess, Senior Vice President and Chief Information Security Officer, BCD Travel; Board Member and Vice President, Strategic Development, Cyversity

Community Day Kick-Off

Presented by: Lance J. Johnson, Executive Director, PCI Security Standards Council

Make Your Voice Heard - A Panel Discussion

Moderated by: Mark Meissner, SVP, Education & Engagement Officer, PCI Security Standards Council

Panelists: Oscar Covers, Chairman of the security working group of the European Card Payment Association (ECPA SWG), European Card Payment Association (ECPA); Gert Huizinga, Senior Consultant Card Solutions, ING; Jeremy King, Regional, VP, EMEA, PCI Security Standards Council; Tomás Perlines, Head of Payment Security, Schwarz IT KG and Marie-Christine Vittet, VP Compliance, Accor

A Review of the 2022 SIG Paper, Guidance for Container and Container Orchestration Tools

Presented by: Daniel Farr, PCI DSS Practice Lead, Foregenix and Mike Thompson, Director, Solutions, PCI Security Standards Council

Community Questions with the Council

Moderated by: Alicia Malone, Senior Manager, Public Relations, PCI Security Standards Council

Panelists: Lance J. Johnson, Executive Director, PCI Security Standards Council and Emma Sutcliffe, SVP, Standards Officer, PCI Security Standards Council

Closing Remarks

Presented by: Sherron Burgess, Senior Vice President and Chief Information Security Officer, BCD Travel; Board Member and Vice President, Strategic Development, Cyversity

Vendor Showcase

14:00 – 17:00

All are welcome to take a sneak peek at the Vendor Showcase!

Welcome Reception at the Spirit De Milan - Via Bovisasca, 57/59, 20157 Milano

Spirit De Milan - Via Bovisasca, 57/59, 20157 Milano MI, ItalyJoin us at the Spirit De Milan to celebrate reconnecting with your peers in person. Take advantage of this exciting networking opportunity while enjoying a taste of Italy in a unique space that will transport you to a typical Italian market complete with lively jazz music and artists. Shuttles will be provided to and from the venue for attendees.

All are welcome! Don’t miss this taste of the city and kick-off networking opportunity!

Wednesday, 19 October

General Sessions

Emceed by: Sherron Burgess, Senior Vice President and Chief Information Security Officer, BCD Travel; Board Member and Vice President, Strategic Development, Cyversity

Welcome Remarks

Presented by: Lance J. Johnson, Executive Director, PCI Security Standards Council

PCI DSS v4.0 In A Nutshell

Presented by: Lauren Holloway, Director, Data Security Standards, PCI Security Standards Council

Quick Fire Round – Your Top 10 Questions About PCI DSS v4.0 Answered

Presented by: Marc Bayerkohler, Standards Trainer, PCI Security Standards Council; Tom White, Senior Manager, Content Development, PCI Security Standards Council and Kandyce Young, Manager, Data Security Standards, PCI Security Standards Council

Keynote - Building on Mars: How Disruptive Technology Development Can Get Us There

Presented by: Melodie Yashar, Space Architect, ICON

Track One

Making the Jump to Light Speed - The Continued Evolution of the Software Security Framework

Presented by: Jake Marcinko, Senior Manager, Solution Standards, PCI Security Standards Council

Track Two

Managing Third Party Risk in the Contact Centre Environment

Presented by: John Greenwood, Director Thought Leadership, Compliance3 Limited and Candice Pressinger, BA Hons, MSc, GDPR Practit., Director, Customer Data Security, Elavon Merchant Services

Our Journey to PCI SLC Compliance

Presented by: Michał Głuchowski, Managing Director, APDU and Kris Olejniczak, QSA, QPA, SSF, SLC QSA, P2PE, Director, EMEA, Online Enterprises DBA Online Business Systems

Eliminating Scope Creep Within a Large & Complex Merchant, Case Study

Presented by: Simon Turner, QSA, CISSP, CISA, CISM., PCI DSS Consulting and Advisory Services Manager (QSA), BT Plc.

Reducing the Human Error Rate

Presented by: James Seaman, MSc, CISM, CRISM, Director, IS Centurion Consulting, Ltd.

Making PCI a People Driven Project

Presented by: Mathieu Gorge, CEO, VigiTrust and Marie-Christine Vittet, VP Compliance, Accor

Preventing Data Breaches: Insights From Real PFI Cases – A Panel Discussion

Presented by: Chris Hague, Divisional Head – Technical Services (DFIR, TIG, SOC), Foregenix, Inc.; Tracey Long, VP, Programs, PCI Security Standards Council; Benn Morris, Managing Director, 3B Data Security and Chris Novak, Managing Director, Verizon Cyber Security Consulting

Increasing Merchant Lifetime Value: Delivering Enhanced Security Capabilities Reduces Merchant Churn and Dramatically Enhances Overall Recurring Revenue

Presented by: Georgios Manoussis, Head of PCI Management, Worldline and Tom Proctor, Commercial Director, VikingCloud

Networking Lunch and Vendor Showcase

Track One

Adopting a Zero-Trust Mindset to Achieve Security From PCI Compliance

Presented by: Phil Lewis, CEO, Titania, Ltd.

Track Two

HSM Virtualization for Payments and Enterprise: Compliance Strategies and Considerations

Presented by: Adam Cason, VP, Global and Strategic Alliances, Futurex and Sam Pfanstiel, Principal, Coalfire

Mobile Payments Update

Presented by: Andrew Jamieson, VP, Solutions, PCI Security Standards Council

Top 10 Challenges for PCI Pen Test Scoping in Cloud Environments

Presented by: Sheryl Benedict, QSA, Principal Consultant, Foregenix Ltd. and Carlos Marquez, Senior Penetration Tester, Foregenix Ltd.

Remote Assessment - Lessons Learned and Looking Ahead

Presented by: Adam Bush, Director, Schellman Compliance and James Hamilton, Department Manager, Information Security, Enterprise Holdings, Inc.

All Things Mobile: Wherever People Pay

Presented by: Mayke Ploeger, Technical Team Lead, Adyen

Navigating PCI Payment Solutions

Presented by: Andrew Jamieson, VP, Solutions, PCI Security Standards Council and Jake Marcinko, Senior Manager, Solution Standards, PCI Security Standards Council

- Different models/approaches

- Risk considerations

- Impact on each other in the same environment

- PCI DSS v4.0 considerations

How PCI DSS Can Help You Securing Your Critical Infrastructure

Presented by: Christopher Kristes, Executive Board Member, usd AG and Vinzent Ratermann, Managing Consultant, usd AG

Track One (Tech Demos)

JavaScript Integrity: The New Attack Surface

Presented by: John Elliot, Security Advisor, Jscrambler

Track Two (Tech Demos)

Foundational Network Configuration Security - Zero Trust and PCI DSS 4.0 Assurance at Scale

Presented by: Ian Robinson, Chief Architect, Titania, Ltd.

VikingCloud Asgard Platform – Providing Continuous Cybersecurity and Compliance

Presented by: Alexander Norell, Global Security Architect, VikingCloud

Why Software Still Stinks and What You Can Do About It!

Presented by: Lisa Parcella, Vice President of Product Management and Marketing, Security Innovation

The Rising Threat of Eskimming and What to Do About It

Presented by: John (JB) Bartholomew, Senior VP of Technology, SecurityMetrics

Networking Reception and Vendor Showcase

Thursday, 20 October

General Sessions

Emceed by: Sherron Burgess, Senior Vice President and Chief Information Security Officer, BCD Travel; Board Member and Vice President, Strategic Development, Cyversity

Welcome Remarks

Presented by: Sherron Burgess, Senior Vice President and Chief Information Security Officer, BCD Travel; Board Member and Vice President, Strategic Development, Cyversity

Industry Keynote - The Payment Threat Landscape: Today and Tomorrow

Presented by: Confidence Staveley, Award-winning Cybersecurity Professional, Cybersecurity Awareness and Inclusion Advocate, Founder and Executive Director, CyberSafe Foundation

As the world becomes more digitally connected and the drive for financial inclusion grows, the payment threat landscape has also expanded. In this session, we explore the connection between the African payment threat landscape and the rest of the world, showcasing creative ideas for driving user-centric cybersecurity awareness campaigns and signposting predictions for the future of payments globally.

Embracing the Journey to PCI DSS v4.0

Presented by: Emma Sutcliffe, SVP, Standards Officer, PCI Security Standards Council

Seismic Change or a Mere Ripple: Changes to Reporting for PCI DSS v4.0

Presented by: John Bloomfield, Manager, Data Security Standards, PCI Security Standards Council and Brandy Cumberland, Director of Program Quality, PCI Security Standards Council

Understanding the New Customized Approach: Separating Fact From Fiction - A Panel Discussion

Moderated by: Lauren Holloway, Director, Data Security Standards, PCI Security Standards Council

Panelists: Marc Bayerkohler, Standards Trainer, PCI Security Standards Council; Brandy Cumberland, Director of Program Quality, PCI Security Standards Council and Tom White, Senior Manager, Content Development, PCI Security Standards Council

Networking Break and Vendor Showcase

Track One

Current Cyber Threat Landscape

Presented by: Dr. Berny Goodheart, Manager, Lab Programs, PCI Security Standards Council

Track Two

Solving PCI DSS v4.0 Challenges With Confidence

Presented by: Loïc Bréat, CISA, CISM, PCI QSA, 3DS QSA, EMEA, Payment Security Practice Regional Lead, Verizon Business Consulting Services – Cyber Security Consulting

The Future of Cyber Risk and Compliance Management for Merchant Service Providers

Presented by: Richard Jones, Business Development Director, Advantio Ltd.

- Placing the emphasis on risk: Techniques to rapidly cyber risk profile and a merchant portfolio.

- Remediation: How SMB merchants can prioritise resource and investment where it will make a difference.

- Raising the cyber security bar for SMB merchants: keeping them safe and ahead of the game.

How to Anticipate the Advent of the Quantum Computer

Presented by: Oscar Covers, Chairman of the security working group of the European Card Payment Association (ECPA SWG), European Card Payment Association (ECPA)

Threats From the Dark Side – A Dark Web Tour From a PCI DSS Perspective

Presented by: Christopher Strand, PCIP, Chief Risk and Compliance Officer, Cybersixgill

Transitioning to PCI DSS v4.0 at a Large European Merchant

Presented by: Tomás Perlines, Head of Payment Security, Schwarz IT KG

Networking Lunch and Vendor Showcase

General Sessions

What’s in a Number? 8-Digit BINs and PCI Standards

Presented by: Emma Sutcliffe, SVP, Standards Officer, PCI Security Standards Council

Exploring What’s In Store With EMV® 3-D Secure

Presented by: Richard Ledain, EMV 3DS Working Group, EMVCo and Mike Thompson, Director, Solutions, PCI Security Standards Council

Top 5 Ways to Engage with PCI SSC and the Community

Presented by: Lindsay Goodspeed, Senior Manager, Corporate Communications, PCI Security Standards Council; Mark Meissner, SVP, Education & Engagement Officer, PCI Security Standards Council and Elizabeth Terry, Senior Manager, Community Engagement, PCI Security Standards Council

Closing Remarks

Presented by: Mark Meissner, SVP, Education & Engagement Officer, PCI Security Standards Council